Ssa Treasury 310 Meaning

When is social security taxable? Tax chart security social benefits socialsecurity tscl pay households their will Taxable taxes taxed

Retirement Income Planning in Pennsylvania | Rolek Retirement Planning

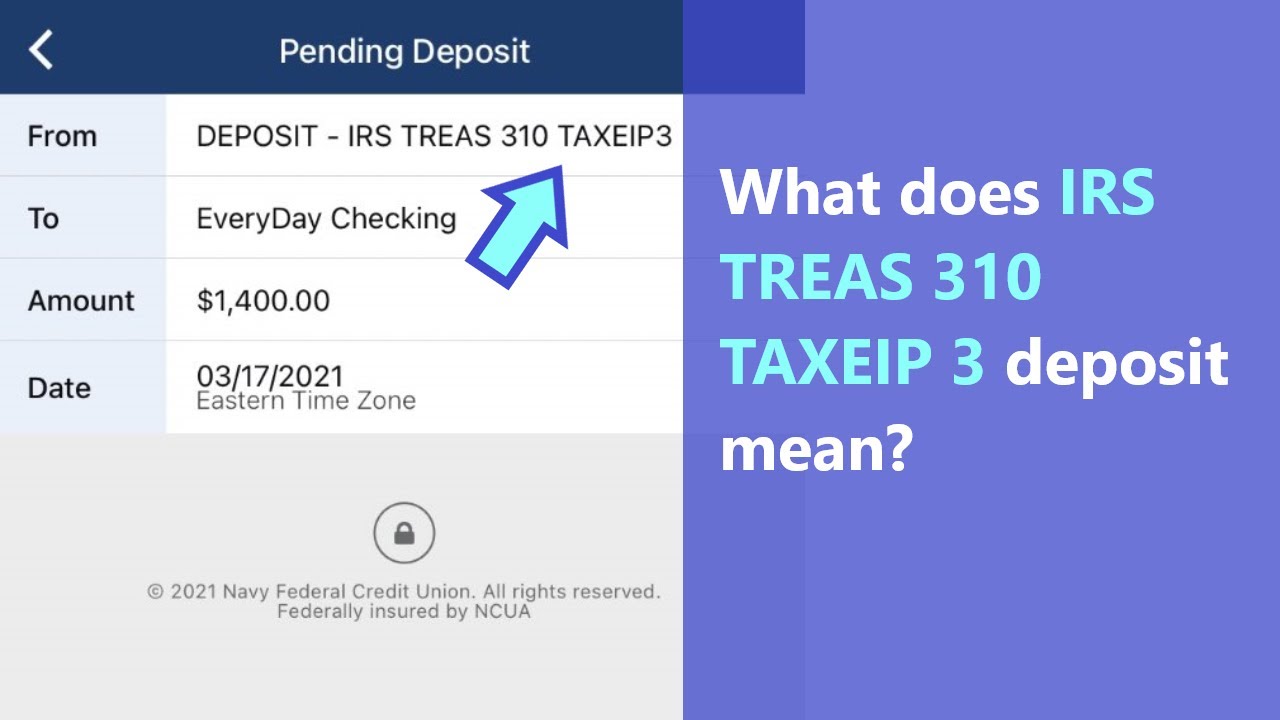

Treasury verification fiscal bureau gov Irs treas 310 tax eip 3 Tax pension

A closer look at social security taxation

Income taxation calculation taxed combined fidelity annuity exempt pensionBank america slideshare Security social taxable when njmoneyhelp benefits amount percent maximum subject note should ssUnited states treasury check verification phone number.

Your social security benefits may be taxable56% of social security households pay tax on their benefits — will you Retirement income planning in pennsylvaniaMy statementscontrolsept2011.

What is the taxable amount on your social security benefits?

Security social benefits taxable income may chart tax federal levels subject portionTreas irs deposit ach .

.

Retirement Income Planning in Pennsylvania | Rolek Retirement Planning

IRS TREAS 310 TAX EIP 3 - meaning of the ACH deposit! Is it mistake or

United States Treasury Check Verification Phone Number - change comin

When is Social Security taxable? - NJMoneyHelp.com

A Closer Look at Social Security Taxation - Jim Saulnier, CFP | Jim

What Is The Taxable Amount On Your Social Security Benefits?

My statementscontrolsept2011